How Today's Fastest-Growing Apparel Brands Are Breaking All the Rules

Heyyoooo!

Remember when starting a successful clothing brand meant securing massive funding, traditional retail distribution, and years of slow, steady growth?

That playbook is officially obsolete.

I've spent the last week obsessively tracking down the meteoric rise of several apparel brands that have shattered convention, and I've identified a fascinating pattern: the fastest-growing names aren't just selling clothes, they're building movements, creating subcultures, and fostering genuine communities in ways traditional retailers simply can't match.

In today's newsletter, I'm taking you behind the scenes of ten revolutionary brands that have reimagined what success looks like in the apparel space. From Nude Project's cultural infiltration strategy to Sporty & Rich's content-first approach, these case studies reveal the exact blueprint today's most innovative founders are following.

Whether you're building a brand, work in an industry, or are just curious about why some companies become popular while others are forgotten, you'll find useful insights ahead.

Let's dive in.

1. Nude Project: From Spanish Startup to Global Streetwear Phenomenon

Nude Project transformed from a small Spanish brand into a global streetwear name by following a clear blueprint:

- Building a subculture, not just a brand – They positioned themselves as the voice of creatives and outsiders, making customers feel they were joining a movement rather than simply buying clothes.

- Leveraging strategic influencer seeding – Instead of traditional advertising, they sent products to streetwear tastemakers and collaborated with Ronaldinho, gaining instant credibility and reach.

- Mastering drop culture economics – By maintaining limited inventory and premium materials, they've created a perpetual cycle of demand and exclusivity with each release.

Takeaway: The most powerful brands sell identity and belonging before they sell products.

2. Madhappy: Purpose-Driven Fashion That Scales

Madhappy isn't merely selling premium hoodies—it's selling mental health awareness and optimism as a lifestyle:

- Embedding mission into every touchpoint – From day one, Madhappy positioned mental health awareness at its core, making purchases feel meaningful rather than transactional.

- Creating experiential retail moments – Their strategic pop-ups in NYC, Aspen, and Miami allowed customers to physically experience the brand ethos, creating memorable touchpoints.

- Leveraging premium pricing psychology – With luxury-level pricing ($165+ hoodies), they've created aspirational positioning similar to Fear of God Essentials, turning basic items into status symbols.

Takeaway: When customers align with your mission, they become advocates, not just shoppers.

3. Represent: The Long-Game Luxury Approach

While others chase viral moments, Represent built a consistent, high-quality brand focused on longevity:

- Committing to elevated essentials – They've maintained focus on premium streetwear with a recognizable aesthetic, avoiding the temptation to chase fleeting trends.

- Prioritizing customer retention – Rather than pursuing new audiences constantly, they've focused on creating lifetime customers through consistent quality and design evolution.

- Creating a collectible ecosystem – Their drop strategy encourages collectors rather than one-time buyers, with each collection feeling like an evolution, not a reinvention.

Takeaway: Building lasting brand equity consistently outperforms short-term hype cycles.

4. Elwood: Basics That Built an Empire

Elwood scaled by perfecting essentials and aligning perfectly with creator aesthetics:

- Designing for content creation – Their oversized tees and vintage washes became the uniform of choice for TikTok creators, generating organic reach.

- Mastering inventory and price psychology – Unlike luxury-positioned competitors, they've kept prices accessible while maintaining consistent availability of bestsellers.

- Embracing subtle branding – Their minimalist approach to logos and branding creates versatile pieces that integrate seamlessly into wardrobes and content.

Takeaway: When executed perfectly, simplified products often outperform complex, trend-driven alternatives.

5. Scuffers: Madrid's Answer to Global Streetwear

Scuffers has disrupted streetwear by blending European minimalism with global street culture:

- Leveraging founder authenticity – Built around personal style rather than market research, early adopters felt connected to the founders' vision and story.

- Prioritizing organic social over paid media – They've let customers and micro-influencers showcase their products naturally, creating authentic digital presence.

- Bridging digital and physical worlds – Unlike purely DTC competitors, they've expanded strategically into physical retail with their flagship Valencia store.

Takeaway: Combining digital-first growth strategies with tactile experiences creates deeper brand connections.

6. Tamed Psychotic: Mystery Marketing Mastery

As one of the most intriguing emerging brands, Tamed Psychotic is implementing advanced brand-building tactics early:

- Creating demand through exclusivity – Their password-protected website generates anticipation and FOMO before customers can even access products.

- Cultivating a cult following – Rather than chasing mass appeal, they've focused intensely on a niche audience aligned with their underground aesthetic.

- Transforming drops into cultural moments – By treating each release as an event rather than a product launch, they maintain exceptional engagement levels.

Takeaway: Strategic scarcity still drives demand, but only when paired with compelling product and positioning.

7. Aimé Leon Dore: Building a Lifestyle Ecosystem

Aimé Leon Dore has crafted a complete lifestyle world that transcends clothing:

- Nostalgia as strategic positioning – They've masterfully blended '90s New York aesthetics with contemporary sensibilities, creating emotional resonance across generations.

- Creating physical community hubs – Their Mulberry Street flagship and Café Leon Dore aren't just retail spaces but cultural gathering points that bring the brand world to life.

- Storytelling through elevated content – Their lookbooks and campaigns feel more like art projects than advertisements, emphasizing narrative over product.

Takeaway: Brands that create immersive worlds beyond products build deeper loyalty than those focusing solely on merchandise.

8. Fear of God Essentials: Democratizing Luxury

Fear of God Essentials has revolutionized how accessible luxury functions in the market:

- Tiered brand architecture – By creating a more accessible sub-brand under the luxury main line, they've captured multiple price points while maintaining brand integrity.

- Minimal branding, maximum recognition – Their restrained aesthetic creates instant recognition without flashy logos, establishing a new visual language for luxury.

- Strategic retail partnerships – Their collaborations with mainstream retailers like PacSun brought luxury sensibilities to mass distribution channels.

Takeaway: Brands can successfully span multiple market segments when architecture and execution maintain consistent quality perception.

9. KITH: Retailer as Cultural Platform

KITH transformed from a sneaker boutique into a cultural institution:

- Experiential retail innovation – Their stores integrate experiences (like Kith Treats cereal bar) that transform shopping into cultural participation.

- Collaboration as content strategy – Each partnership, from luxury fashion houses to cereal brands, becomes an anticipated cultural moment rather than a simple product release.

- Elevating the mundane – By treating everyday items with the reverence typically reserved for luxury goods, they've redefined what customers consider valuable.

Takeaway: Retailers can build brand equity that rivals or exceeds the brands they carry when they create distinct cultural positioning.

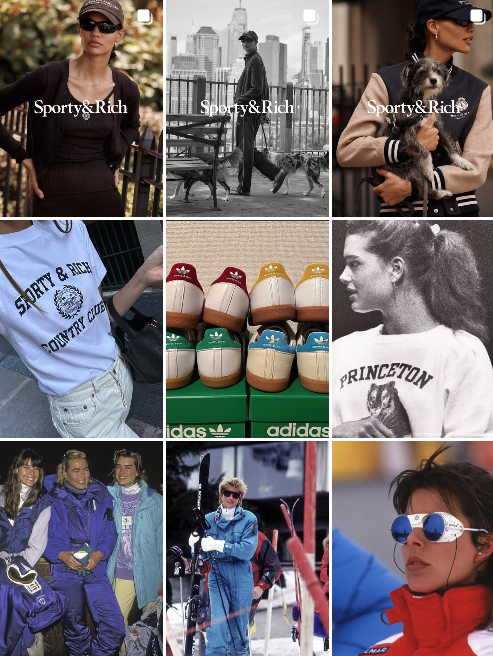

10. Sporty & Rich: Content-First Brand Building

Sporty & Rich began as a mood board before becoming a fashion brand:

- Editorial foundation – By starting as a magazine/Instagram concept, they built audience and aesthetic clarity before creating products.

- Wellness as lifestyle positioning – Their "Health is Wealth" ethos connected fashion to broader lifestyle aspirations beyond style.

- Intentional scarcity with consistent aesthetics – Limited drops maintain exclusivity while their core aesthetic remains consistent, creating continuity across collections.

Takeaway: Building audience and vision before product allows for deeper market connection when launching.

Every breakout brand has one thing in common: People talk about them.

So I’ve got my homie Alonzo here to share how Flywheel is making that happen—through Instagram Stories.

A while back, I posted an Instagram Story about a product I loved. Just a quick share. Five friends replied. One of them posted their own Story. Four of them bought it.

The brand?

Had no idea any of this happened. No tracking, no engagement, no way to turn that organic momentum into something bigger.

But here’s the thing, if I could do that without an incentive, imagine how many more would with the right nudge.That’s where Flywheel comes in. We turn email into a social sharing engine for Instagram Stories, making it effortless for customers to share and for brands to finally track, reward, and scale organic growth. → [See How It Works]

The ten brands we've explored today couldn't be more different in their aesthetics and target audiences, from Nude Project's streetwear revolution to Madhappy's mental health mission to KITH's cultural institution status.

Yet beneath these differences lies a consistent truth: the apparel brands winning today understand they're in the identity business, not the clothing business.

What's most fascinating is how these brands have managed to create scarcity and exclusivity while simultaneously building inclusive communities. It's this delicate balance, making customers feel both special and connected. Traditional retailers have consistently failed to achieve this.

As we look ahead to the next wave of innovation in this space, I'm particularly intrigued by how these community-first principles might extend beyond apparel into adjacent categories. The lessons from Aimé Leon Dore's lifestyle ecosystem or Fear of God Essentials' tiered luxury approach offer a roadmap that transcends fashion.

I'll be tracking these trends closely and sharing more insights in coming newsletters.

Until next time,

Zach

P.S. If you found value in this breakdown, consider sharing it with a friend or colleague who's interested in brand building, consumer trends, or the future of retail. And as always, hit reply with any thoughts—I read every message.